Brambles' financial results for the 12 months ended 30 June 2015 reflected sales revenue and profit growth from continued execution of the Group's organic growth strategy and contribution from acquisitions made since the start of the prior corresponding period.

The delivery of operating efficiencies resulted in an increase in the Underlying Profit margin, while the modest decline in key return on capital measures reflected the impact of acquisitions.

The variance between actual and constant-currency performance was driven by the strengthening of Brambles' reporting currency, the US dollar, relative to the Group's other operating currencies, particularly the euro.

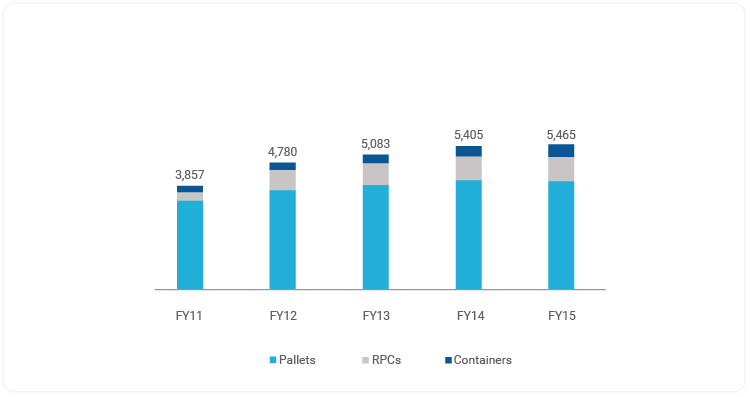

Sales revenue from continuing operations was US$5,464.6 million, up 1%. Constant-currency sales revenue growth of 8% was in line with guidance of 8% to 9% constant-currency growth for FY15 and the five-year objective for average annual constant-currency percentage sales revenue growth in the high single digits. Constant-currency growth in FY15 was primarily driven by: market-share expansion in the Pallets and RPCs segments; pricing and volume growth in the Pallets segment; and acquisitions in the Containers segment. Excluding the contribution of acquisitions, constant-currency sales revenue growth was 6%.

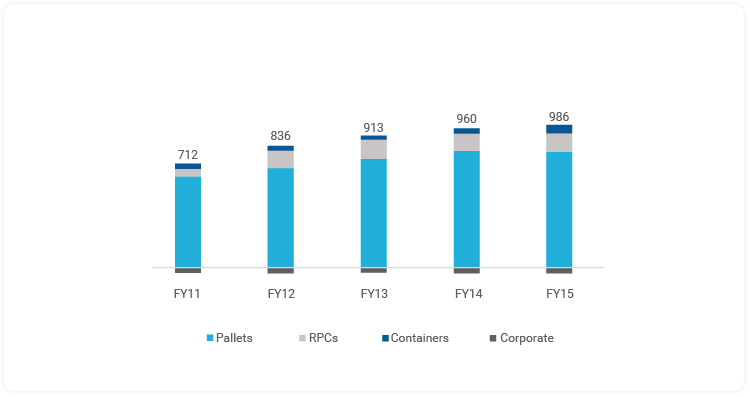

Underlying Profit, which excludes Significant Items, was US$985.8 million, up 3%. Constant-currency growth of 10% was driven by: sales revenue growth; the delivery of the final US$34 million of efficiencies under the Global Supply Chain program in Pallets; and a reduction in overheads as a proportion of sales revenue. These drivers more than offset: higher plant and transport costs in the USA pooled pallet operations; increased depreciation costs from pool growth in the Pallets and RPCs segments; the increased cost of pallet cores in the USA recycled pallet business; and the recognition within continuing operations of an additional US$10 million of corporate costs (which in FY14, were recharged to the Recall business demerged in December 2013). Excluding acquisitions, constant-currency Underlying Profit growth was 8%.

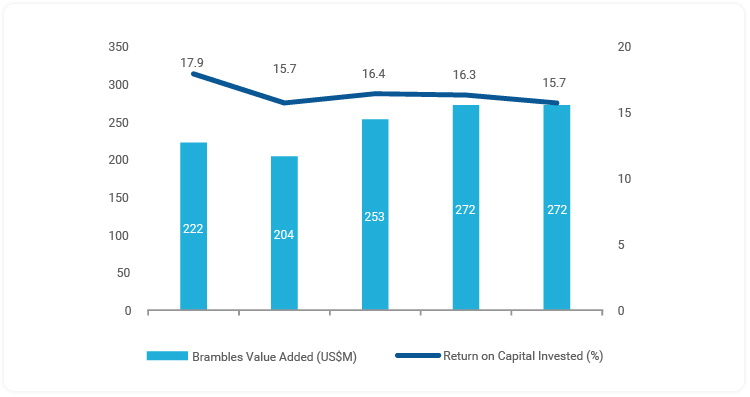

Return on Capital Invested was 15.7%, down 0.6 percentage points, reflecting the impact of acquisitions made since the beginning of the prior corresponding period. Excluding these acquisitions, Return on Capital Invested was 16.6%, up 0.3 percentage points, as strong profitability gains in the Europe, Middle East & Africa (EMEA) region of the Pallets segment and in the RPCs segment more than offset lower profit in Pallets Americas.

Average Capital Invested was US$6,291.0 million, up 7% (up 14% at constant currency), reflecting acquisitions since the start of the prior corresponding period (Airworld in February 2014, Transpac in June 2014, Ferguson in September 2014 and Rentapack in May 2015). Excluding acquisitions, constant-currency growth was 5%.

Brambles Valued Added was US$272.0 million, down US$0.2 million, reflecting the same trends as for Return on Capital Invested.

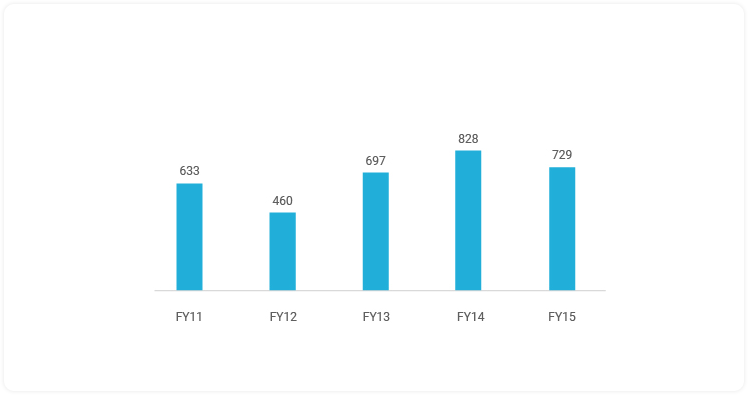

Cash Flow from Operations was US$728.8 million, down US$99.4 million, driven by higher capital expenditure.