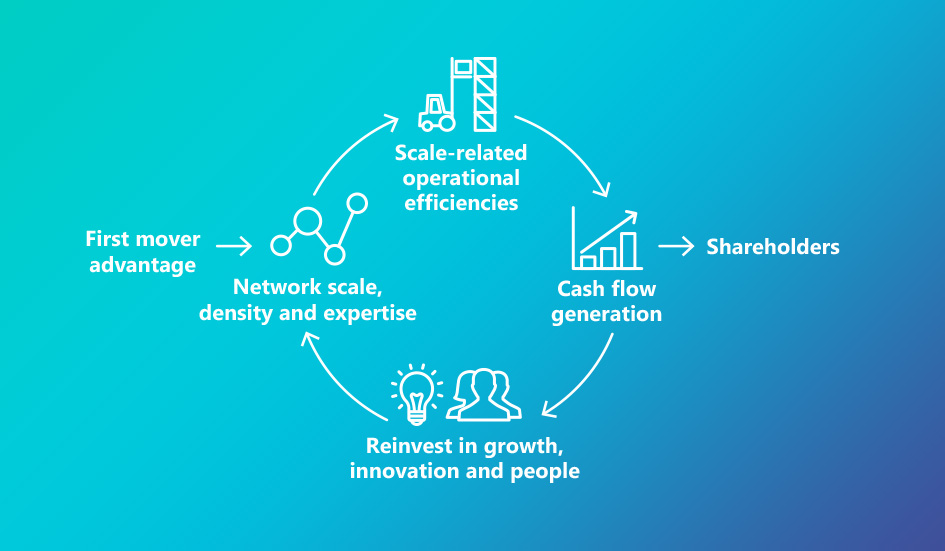

Brambles generates value through

a virtuous circle that leverages its

network advantage of scale, density

and expertise to achieve superior

operational efficiencies.

These efficiencies in turn generate

cash flow that can either be returned

to shareholders or reinvested in the

business to fund growth, innovation

and development of its people.

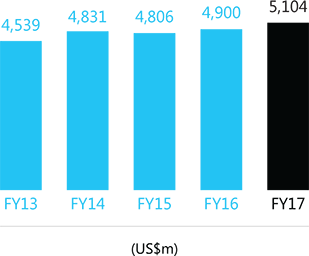

Long-term Value Creation and Superior Shareholder Returns

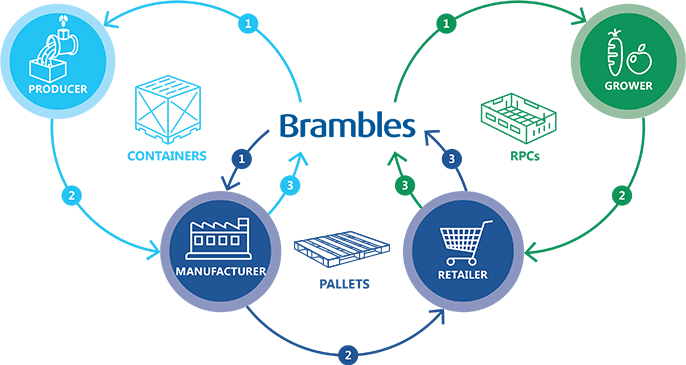

Brambles shares the efficiencies generated by its scale, density and expertise with its customers, providing a compelling value

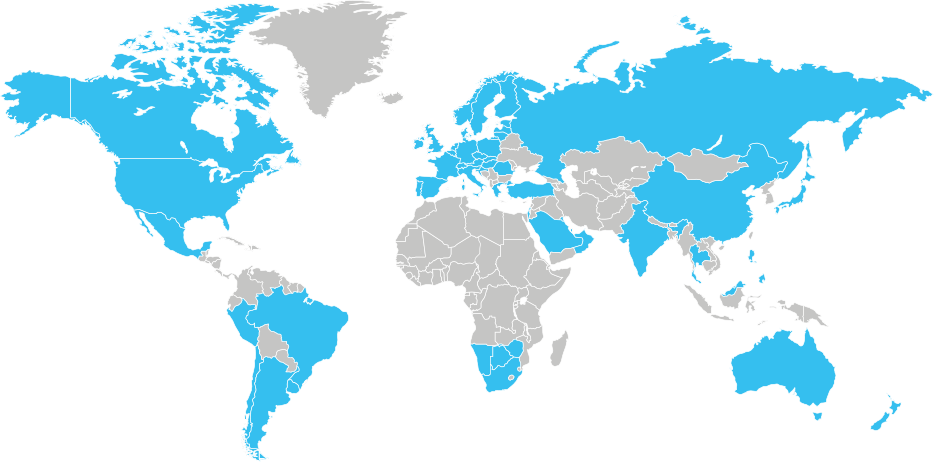

proposition compared to alternatives. By providing customers with supply chain solutions in over 60 countries, Brambles offers

shareholders exposure to geographically diversified earning streams primarily from the global consumer staples sectors.

The supply chains served by Brambles also provide a broad range of growth opportunities including: increasing penetration of

core equipment-pooling products and services in existing markets; diversifying the range of products and services; entering new

and adjacent parts of existing supply chains; and exploring the digitisation of supply chains.

Within this context, Brambles is committed to striking the right balance between growing its business and delivering superior

shareholder returns over the long term. By focusing on its core drivers of value, Brambles expects to deliver through the cycle:

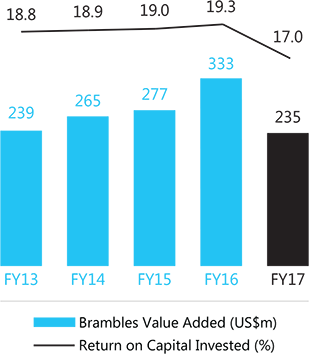

Sustainable growth and returns well in excess of the

cost of capital

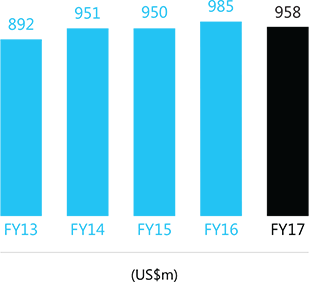

- Sales revenue growth2 in the mid-single digits;

-

Underlying Profit growth2 in excess of sales revenue

growth; and

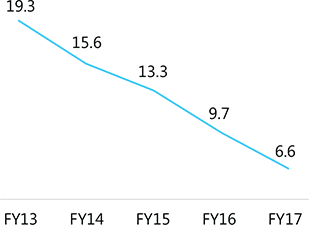

- Return on Capital Invested in the mid-teens.

Cash generation to fund growth, innovation

and shareholder returns

-

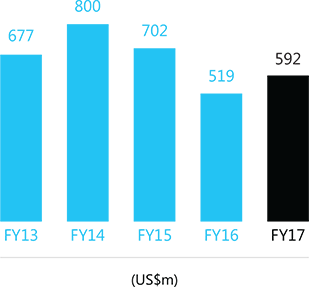

Free Cash Flow sufficient to fully fund capital expenditure

and dividends

Dividend Policy and Payment

Brambles has a progressive dividend policy. Under this

policy, the Group seeks to maintain or increase dividend per

share each year, in Australian cents, subject to its financial

performance and cash requirements.

The Board has declared a final dividend for 2017 of 14.5

Australian cents per share, in line with the previous interim

and final dividend. The 2017 final dividend will be 30%

franked and is payable on 12 October 2017 to shareholders

on the Brambles register at 5.00pm on 14 September 2017.

The ex‑dividend date is 13 September 2017.

Total dividends for the Year were 29.0 Australian cents per

share, in line with the prior year. Brambles paid the 2017

interim dividend of 14.5 Australian cents per share on

13 April 2017.

Dividend Reinvestment Plan

Brambles’ Board maintained the Dividend Reinvestment Plan

(DRP) for the 2017 financial year. Shares issued under the DRP

do not attract a discount. Any dilutive impact on earnings per

share of DRP-issued shares will be neutralised through the

transfer of existing shares to participating shareholders via

on‑market purchases rather than issuing new shares to them.

ESG Recognition

Third-party Environmental, Social and Governance (ESG) investor research consistently recognises Brambles’ strong

governance processes and the long-term sustainability of its business model and strategies. In 2017, Brambles was

placed amongst the leading companies in the global industrial services sector by the following ESG research firms: